A leading tech investment banking boutique in SE Asia

Your trusted adviser and partner for fundraising, M&A and eventual exit

Our Founder

SEAbridge was founded in 2012 by Marcus Yeung with the aim of becoming the trusted adviser to the best tech companies in SE Asia, leveraging his uniquely deep experience as investor, entrepreneur and banker.

Marcus Yeung

Founder and Managing Partner, Singapore

Marcus is a highly sought after deal maker and adviser with a wealth of experience spanning over two decades. With a unique combination of experience as Founder, CEO, CFO, PE/VC/Corporate Investor, Lender and Investment Banker, he has deep insight on all sides of an investment and is well placed to facilitate investments in Asia. Marcus is known for his hands-on, creative and entrepreneurial approach to deal making while maintaining his core values of humility, integrity and gratitude.

Marcus has founded, grown, invested in, managed, advised and sold over 100 businesses in Asia, Japan and the UK. His deep business experience has been honed through senior management positions in the corporate and financial world:

- Founder and CEO of Smooch Japan, a pioneer in the Japanese F&B market

- Co-founder and Managing Partner of Crimson Phoenix, a leading M&A boutique in Japan

- Executive Director of The Carlyle Group, a top private equity fund in Japan

- CFO of Singapore Power International, a major energy investor in Asia

- Director of SG Warburg, a top UK investment bank

Aside from his business expertise, Marcus is also fluent in both English and Japanese and is a balletomane and a qualified fitness instructor and is also a qualified fitness instructor.

Transactions

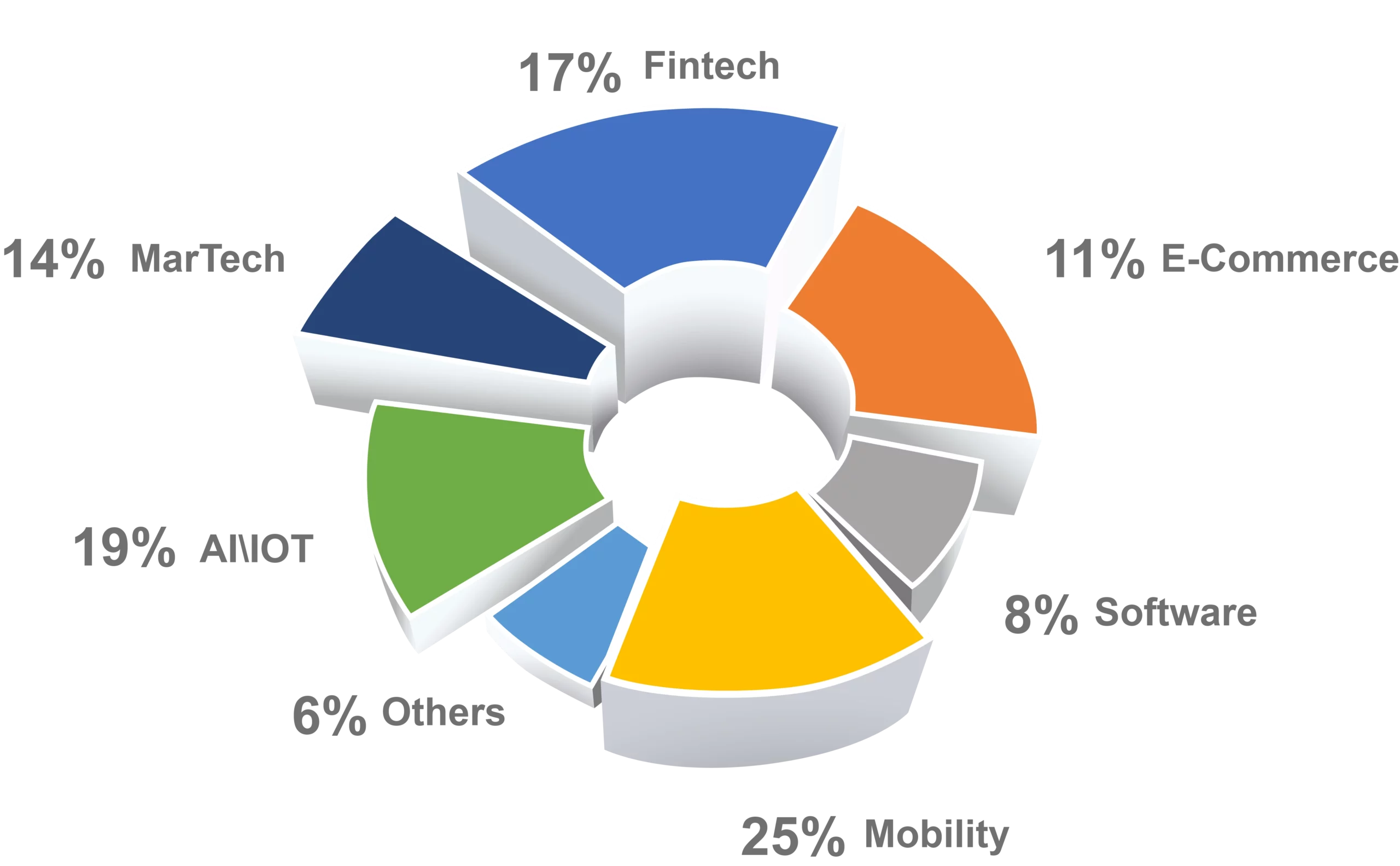

SEAbridge Engagement by Vertical

Here are some examples of recent engagements:

(Fundraising)

(M&A)

(M&A and Strategy)

(Private Placement)

(Fundraising)

GLOBAL REACH THROUGH GLOBALSCOPE

GLOBALSCOPE

55 independent M&A firms, 1 global family

SEAbridge is a proud member of GlobalScope, a leading group of corporate finance and M&A advisors operating globally, giving us a wide access to investors globally.

Transactions

in 2022

Happy

Clients

Independent

Firms

Countries Across

5 Continents

Transaction

Value in 2022

Global Scope

Singapore

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation

Indonesia

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation

Japan

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation

Lorem Ipsum

Client Testimonials

Patrick Linden

Co-Founder & CEO, Deep Green Group

“I started working with SEAbridge in 2013 for fundraising and eventual M&A planning for my first tech startup in South-East Asia. Fast forward to today, our cooperation spans across 3 successful companies in which Marcus and his team have been instrumental in our fundraising and M&A processes.

While working closely together, I highly valued Marcus’ strategic insight and deeply thought-through approach. The quality of work SEAbridge delivers is top notch. Marcus knows how to unearth considerable – and sometimes hidden – value in an opportunity in order to maximize outcomes. Moreover, his network access into the tech and financing space, especially in Asia, but also on a global level, is clearly unique.

John Palmer

Regional Head APAC, Eco Energy World PLC

“I have worked with Marcus and the team at SEAbridge on several investment transactions over the years.

I choose to work with SEAbridge because of their deep expertise and network, especially in tech and SE Asia.

Marcus is a deal maker – he has unique insight gained from many years investment experience and sees opportunities clearly. His team handles the most complicated of transactions pro-actively and professionally. For those companies looking to partner with a trustworthy financial adviser, I am happy to recommend SEAbridge.”

Peter Kennedy

Senior Adviser, Burda Principal Investments

“We engaged SEAbridge as exclusive financial adviser on the sale of one of our portfolio companies.

The deal was complicated in structure, and involved multiple parties and jurisdictions. They managed all these relationships with professionalism and patience.

SEAbridge did an excellent job of managing the M&A process as well as the multiple parties involved. They are highly competent, hands-on and insightful.

I am happy to recommend SEAbridge to tech companies as a quality M&A adviser.”

Giselle Makarachvili

CEO, Hmlet

Jonathan Bonsey

Principal Creative and Executive Officer, Bonsey Design

“SEAbridge was engaged as exclusive financial adviser on the sale of a company I was a shareholder in.

Overall, Marcus and the team at SEAbridge did an outstanding job of running the M&A sales process. They played a pivotal role in facilitating a very complicated transaction involving multiple parties from Japan to Australia.

They are insightful, pro-active, hands-on and creative. I am happy to recommend SEAbridge to companies looking for a high quality M&A adviser to guide them through the complicated M&A process.”

Nic Robertson

Co-Founder, Bonsey Jaden

“SEAbridge has been our trusted adviser for our corporate finance and strategic initiatives for several years. We have worked closely with Marcus and his team at SEAbridge as exclusive financial adviser on our fund raising, capital restructuring and our ultimate sale to a strategic buyer.

We have found SEAbridge to be more than just an adviser, they are a reliable and hands-on partner, who can give invaluable insight into complex investment situations and to facilitate win-win solutions for the various parties involved. I highly recommend Marcus and the SEAbridge team as a trusted partner for corporate finance advisory work.”

Daniel Posavac

Group CEO and CO-founder, Bonsey Jaden

“As the Group CEO of Bonsey Jaden I have been working with Marcus and SEAbridge since 2016 on multiple fundraising rounds (capital & debt), which culminated in SEAbridge advising us on the sale of Bonsey Jaden to CUE in 2021.

Marcus is the ultimate business partner, and throughout our years of working together has become one of our closest of most trusted advisors. My experience with Marcus has been outstanding, which is why we have engaged him and SEAbridge at every opportunity over the past 7 years.

SEAbridge are very strong at quickly understanding the business, and identifying strategic opportunities to strengthen the business position in preparation for fundraising or M&A. They are also fantastic at identifying the best financing strategies, and developing a roadmap for success. Finally they have fantastic attention to detail, and are outstanding at partnering with executives through every step of the process.

The key value SEAbridge brought to me and the process can be summarised as experience and expertise. They have a depth of experience which helped set the right strategy for our business, and their expertise across every part of the process was invaluable as we navigated through fundraising and M&A.

I absolutely recommend SEAbridge, and I cannot wait to work with Marcus again. Simply put, SEAbridge have been successful in every engagement with Bonsey Jaden, and have always been fantastic partners and excellent people to work with.”